Cap Table Management

Employee Stock Plan Tracking

Scenario Planning Tools

BoardNotes

Globally Compliant

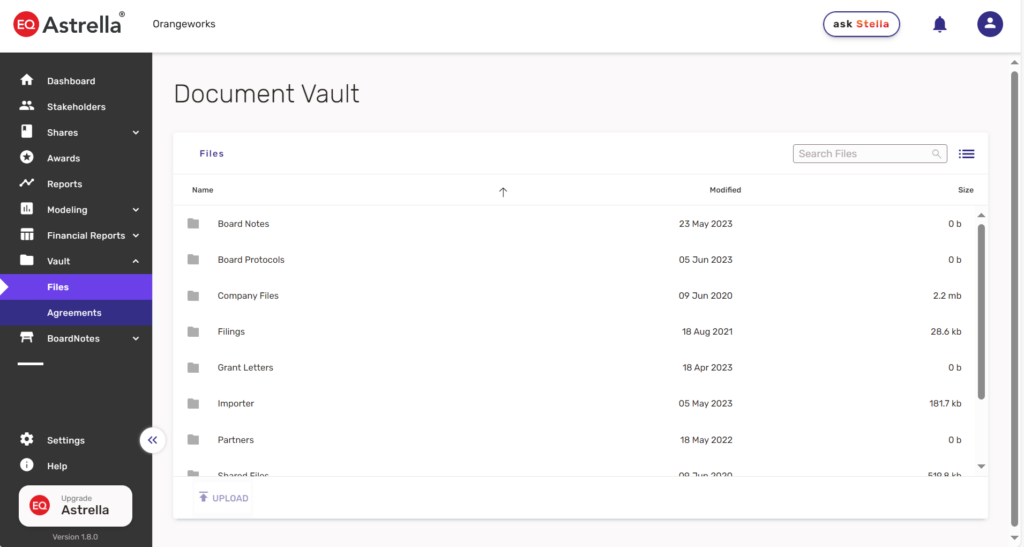

Document Vault

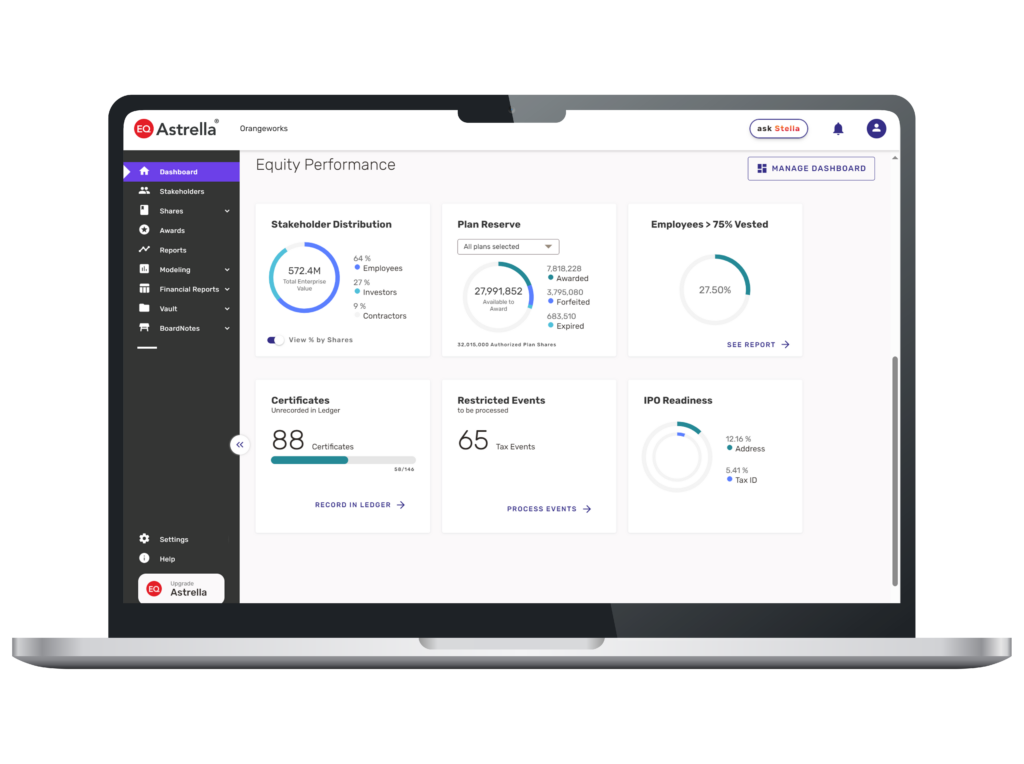

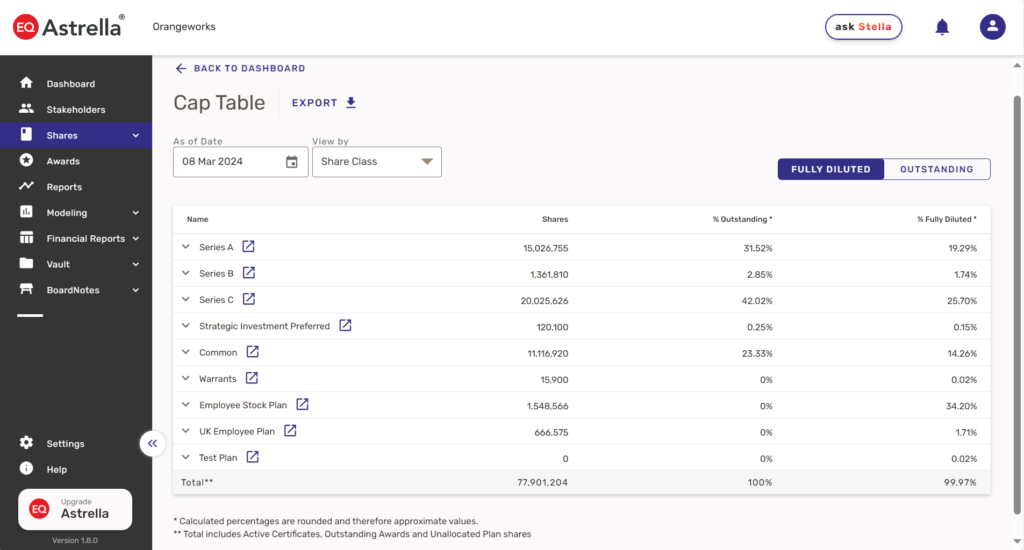

Cap Table Management

Manage and create cap tables with ease and precision using Astrella’s cap table management software.

Our solution automates the cumbersome administrative processes while preserving complete transparency and control.

This intuitive system helps save time, so you can focus on the success and growth of your business.

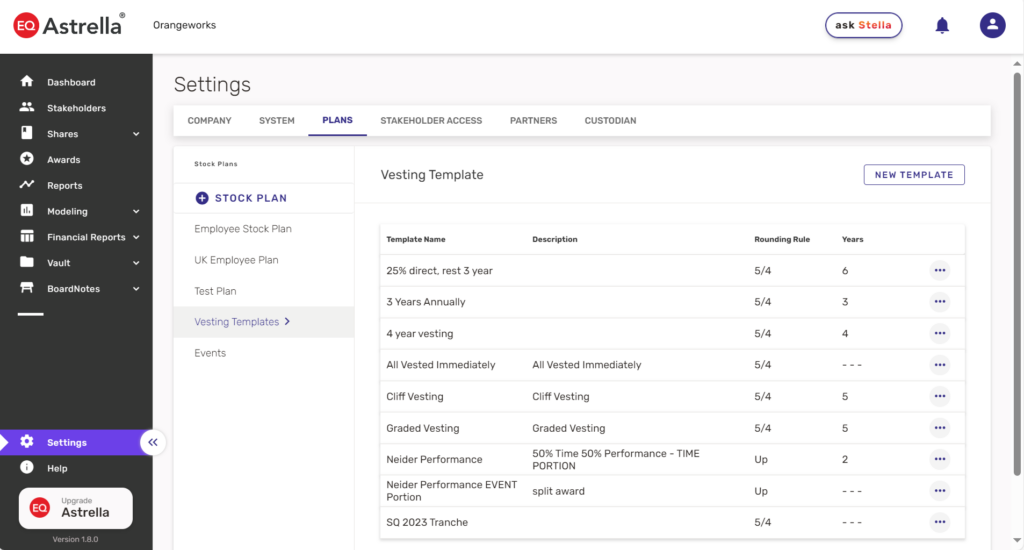

Employee Stock Plan Tracking

Including employee stock options has its benefits, but updating ownership data for a growing number of employees can get out of hand quickly.

With our cap table management solution, you will have access to intuitive employee stock plan tracking.

Issuing equity and establishing vesting schedules have never been easier.

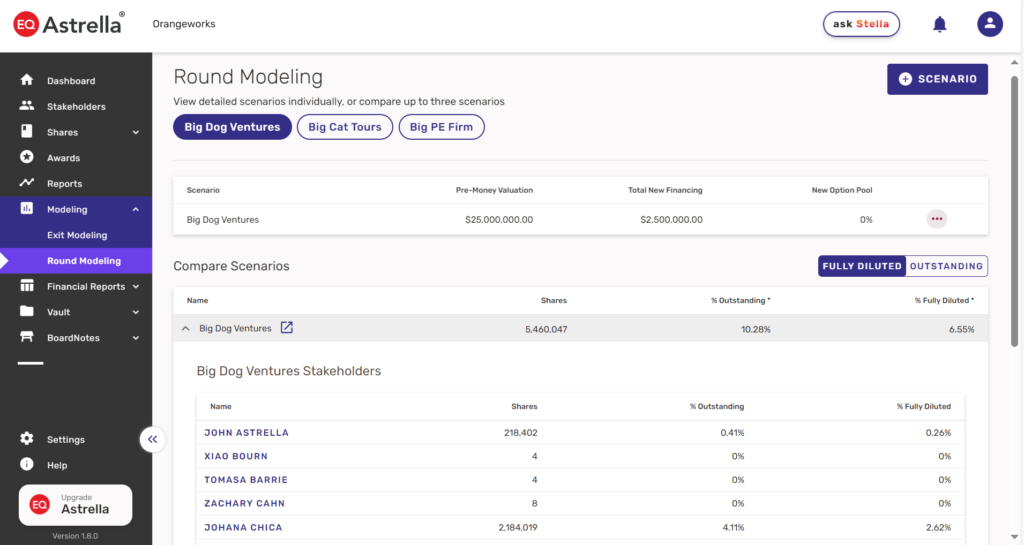

Scenario Planning Tools

As a business owner, you want to think three steps ahead to determine the most profitable financial decisions.

With our scenario planning tools, you can run expense simulations based on any situation, including financing rounds, exit scenarios, and more.

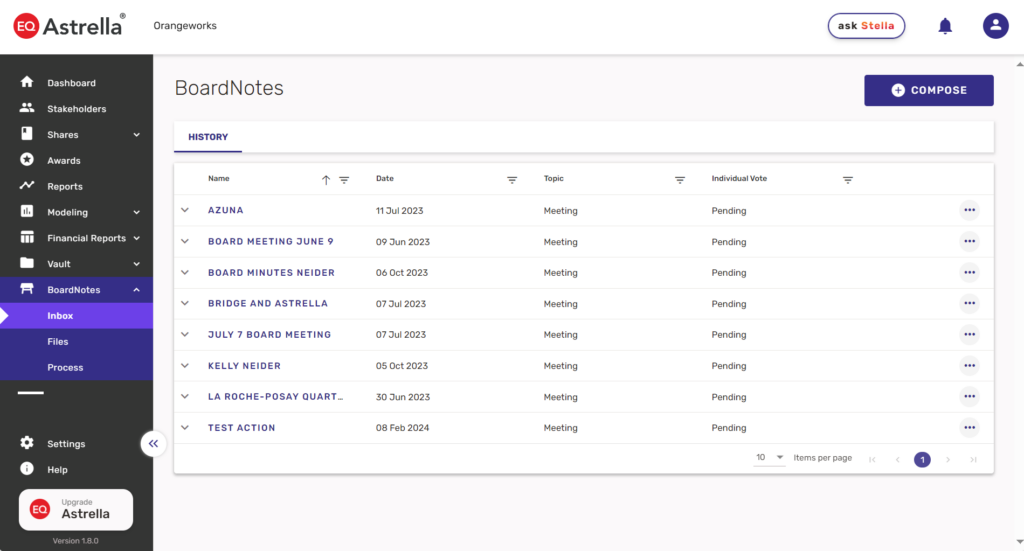

BoardNotes

Every business must maintain records of their board meetings to meet government regulations.

Our newest technology will record, transcribe, and store meeting minutes into the secure Astrella ledger.

Globally Compliant

Document Vault

Store all necessary documents and resources in a single, globally compliant document vault.

Our cap table solution offers simple equity management for companies of all sizes and various currencies.

Your North Star

for Equity

Management.

We guide you through your immutable audit trail journeys from startup to exit

Stay Compliant, Transparent, and Secure with Powerful Equity Management from Astrella

Managing equity is the cost of doing business, but a cost that can turn into a profitable engine of growth for your company. The Astrella equity management platform helps companies, from startups to employee-owned organizations and publicly traded businesses, maintain the most accurate and trustworthy view of their equity. No matter where they are in their ownership journey, these companies trust Astrella to help them understand their value, prepare for their IPO, and utilize equity to attract top talent.

Equity investments provide essential capital for growth and expansion, attract top talent through stock-based compensation, and position your business for potential future funding rounds or lucrative exit opportunities. They also come with great responsibility to manage and track that equity accurately.

If you’re new to equity management, keep reading to learn all the basics: what it is, who’s involved, best practices, and the key benefits of using equity management software.

What is equity management

When your company begins issuing shares, you must keep a distributed equity record. This ensures that you can provide all shareholders with an accurate view of company ownership.

As your company grows, the administrative and communication duties required to manage your equity become difficult to keep up with. These activities include:

- Tracking and updating ownership changes on a capitalization table (cap table) is a record of who owns what percentage of the company.

- Offering compensation plans to motivate and keep valuable employees by giving them a chance to become shareholders.

- Following legal and regulatory requirements to ensure compliance with the law and accounting standards.

- Sharing vital information with investors, such as major changes, new hires, and business milestones.

Managing your company’s equity is important in motivating valuable employees, building goodwill with shareholders, and attracting new investors. It ensures transparency and clarity in the ownership structure, enabling stakeholders to understand their ownership stakes accurately and helping to create a positive and collaborative work environment.

What do Equity Administrators Do

Equity administrators are professionals who can help businesses track ownership correctly and stay compliant with the law. A good equity administrator is knowledgeable about relevant regulations, has a sharp eye for detail, and is comfortable dealing with complex financial calculations. Today, software solutions are instrumental in helping equity admins gather and aggregate data that helps them see businesses in greater detail.

Generally, equity management involves these key responsibilities:

- Manage the company’s cap table: A cap table is an official document listing all your company’s securities and owners. Managing this document involves documenting equity issuances, handling exercises and transfers, and updating the cap table after events like financing rounds or liquidity events. They also share the updated cap table with relevant stakeholders to fulfill any reporting requirements to investors.

- 409A valuations: This appraisal determines your common stock’s fair market value (FMV), which helps the board establish the share price. Appraisals are a regular occurrence. 409A valuations should happen every 12 months or whenever a material event occurs, whichever happens earlier. Material events include significant changes that might influence your company’s stock FMV, such as qualified financing rounds, mergers, acquisitions, or other significant business alterations.

- Ensure compliance: To adhere to accounting standards, most companies follow the Generally Accepted Accounting Principles (GAAP) when recording employee equity issuances. They must also follow federal and state-level securities laws, including ASC 718 and Rule 701.

Who are Your Equity Holders

An important part of equity management is keeping accurate records of all stakeholders who hold ownership interests in the business. These stakeholders are typically categorized as follows:

- Founders: The individuals or group of people who establish the company and take on significant initial ownership stakes.

- Investors: External individuals, venture capital firms, or angel investors who invest capital in the company in exchange for equity ownership.

- Employees: Employees may be granted stock options, restricted stock units (RSUs), or other forms of equity as part of their compensation packages, making them stakeholders in the company’s success.

- Board members: Directors on the company’s board often hold equity positions and play a critical role in decision-making and corporate governance.

- Advisors: Advisors, consultants, or mentors who contribute to the company’s growth may receive equity compensation as a form of appreciation for their guidance and expertise.

- Preferred stockholders: Investors who hold preferred shares often have priority over common shareholders in terms of dividends and liquidation preferences.

- Common stockholders: The most common type of equity stakeholders, common stockholders, include founders, employees, and sometimes early-stage investors. They have voting rights and typically share in the company’s profits after preferred stockholders.

- Convertible note holders: Individuals or entities that have invested through convertible notes, which can be converted into equity at a later stage, typically during a financing round.

- Warrant holders: Warrants give the holder the option to purchase shares at a predetermined price, allowing them to become equity stakeholders if they exercise the warrants.

Each type of equity stakeholder has different rights, privileges, and potential financial gains based on their ownership position in the company. As your company grows and goes through funding rounds, the composition of its equity stakeholders may change. The constant fluctuation of ownership means having a dedicated team of professionals and a reliable platform to handle equity management is critical.

Equity Management Best Practices for Startups

Equity management is a critical process that can’t be ignored or mismanaged. As you get started on your equity management journey, here are some best practices to keep in mind:

- Maintain an accurate cap table: Keep an up-to-date cap table that records all equity issuances, transfers, and changes in ownership. Regularly review and reconcile the cap table to ensure accuracy and transparency in the company’s ownership structure.

- Have a process for remaining compliant with legal and regulatory requirements: Stay informed about securities laws and accounting standards relevant to equity management. Comply with reporting obligations, including those associated with 409A valuations, to ensure that equity issuances are properly valued and aligned with regulatory guidelines. Equity management software can be a useful tool for staying current with requirements and identifying small errors that could have big legal implications.

- Keep an open line of communication with stakeholders: Have a clear process for keeping all equity stakeholders informed of their equity plans, vesting schedules, and any potential liquidity events. Providing regular updates about changes in ownership and other equity-related matters helps build goodwill and confidence in your company.

- Implement equity management software: In the beginning, an Excel spreadsheet may be all you need to track your company’s equity distribution. But as your company grows, so will the complexity of equity management. At some point in your journey, you’ll likely start taking advantage of specialized equity management software to minimize the time and potential errors that come with trying to manage your company’s equity manually in spreadsheets.

The Benefits of Using Equity Management Software

Equity management software offers numerous benefits for startups and companies of all sizes. These platforms help streamline the entire equity management process, from issuing equity to stakeholders, tracking vesting schedules, and maintaining an accurate cap table. This increased efficiency reduces the risk of errors and ensures compliance with regulatory requirements.

Equity management platforms also enhances transparency, enabling stakeholders to access real-time information about their ownership interests. Finally, the software’s automation and centralized data storage help simplify communication with employees, investors, and other equity holders, facilitating seamless reporting and updates.

Learn more about how Astrella equity management solutions can save time, minimize administrative burdens, and promote a smoother, more organized approach to equity management. Read Less

Equity Management Software FAQ

- Cap Table Management: Astrella simplifies cap table management with its intuitive software, leveraging artificial intelligence and blockchain technology to automate administrative tasks while maintaining transparency and control.

- Simple & Secure Setup: Astrella offers a quick and easy setup process, allowing startup founders to establish a clean cap table efficiently.

- Employee Stock Plan Tracking: Astrella provides intuitive employee stock plan tracking, making it easy to issue equity and establish vesting schedules.

- Scenario Planning Tools: Astrella’s scenario planning tools enable business owners to make informed financial decisions by running simulations for various situations, including financing rounds and exit scenarios.

- Robust Reporting Capabilities: Astrella offers robust reporting capabilities, providing detailed analyses and reports to ensure the best investor experience.

- Genealogy Tracking: Astrella allows users to track the genealogy of company shares and stakeholders in real-time.

- Secure Mobile App: Astrella’s secure and user-friendly mobile app enables users to access ownership data from anywhere, ensuring constant connectivity with shareholders and transactions.

- Regulatory Compliance: Astrella ensures regulatory compliance with regular audits for 409a valuations, maintaining readiness for audits.

- Globally Compliant Document Vault: Astrella provides a globally compliant document vault for storing all necessary documents and resources in one place.

- Free White-Glove Onboarding: Astrella offers expert assistance to configure the cap table perfectly.

- Extended Free Use: Committing to a two or three-year plan with Astrella grants up to a year of free access.

- Competitive Pricing Advantage: Astrella promises to halve your current Carta invoice.

- Expert Support: Astrella provides a free investor due diligence call and ensures a swift transition, typically completed within three weeks.

Astrella and Industry Use Cases

Legal requirements, tax reporting, talent acquisition … the truth is that equity management is a multi-industry concern. Whatever your business, industry, or customer base, how you manage stocks and equity will help determine how productive and profitable your journey is.

Fortunately, Astrella has got you covered.