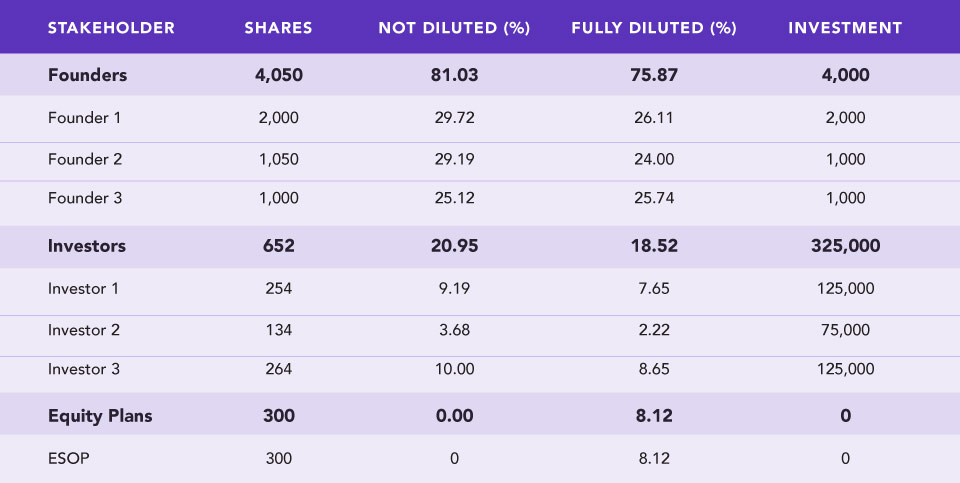

A cap table is an abbreviation for a capitalization table. A capitalization table in many cases is private information to a company that shows its ownership shares, investment, and market value. The spreadsheet breaks down the company’s equity ownership capital information which includes:

- Common equity shares

- Preferred equity shares

- Warrants

- Convertible equity

A cap table is vital to a company as it’s a key reference point in making all financial decisions. That way, the owners minimize losses and avoid unnecessary “damage repair” exercises.

Cap Table Dilution

Dilution in a cap table is the decrease in an ownership share interest per shareholder within the company. That happens when a company issues new shares for investment purposes.

However, a cap table dilution affects the organization and shareholders differently, depending on the situation. High equity dilution results in weak investor support because it repels new investors. Therefore, it’s best to maintain minimum equity dilution levels to ensure a high business potential value.

Fully Diluted Cap Table

A fully diluted cap table contains all the current, outstanding shares for every security (including convertible security).

A fully diluted cap table shows the business owners all possible prospective equity financing sources. Conversely, a company can receive capital investments without exchanging ownership interest with the funder meaning there will be no dilution.

How to Calculate Cap Table Dilution

Calculating the cap table dilution involves subtracting the number of outstanding shares from the number of issued shares.

Remember:

Number of outstanding shares = Percentage of ownership before investment

Number of issued shares = Percentage of ownership after investment

Below are the steps you need to follow:

- Calculate the percentage of equity ownership by comparing the total outstanding shares with the total number of issued shares.

- Compute the additional number of shares issued to use in step 3.

- Calculate the ownership percentage after the investment round or after issuing additional shares.

- Lastly, to get the percentage value of dilution, simply subtract the percentage of ownership before investment from the ownership percentage after investment.

Step-by-Step Dilution Calculation

Let’s get into the nitty-gritty of what happens to a start-up company and how you can calculate the cap table dilution as your business grows.

Hiring

When you initially start your business, you’ll own 100% of the shares. Then as you expand the company and hire other staff they get to own part of the 100%. Perhaps, the new team takes 10%, then that means that now you own 90%.

Seed Rounds and Funding

Soon, you decide to collaborate with investors who can fund your business to spur up the marketing and profitability of your business. Let’s say you find a good investor who invests 10% equity.

At this point:

- You will own 81%

- The investor will get their 10%

- And your staff will own 9%

How do we get the above results?

- Your share = The initial holding you had X the investors ownership position (90X90=81)

- Your staff’s share = The initial holding you had X their share (90X10=9).

Series A

Fortunately, the seed round and funding help you scale up and you’re excited to invest more! And you’re lucky to find a capital investment company that agrees to an ESOP of 10%. However, the ESOP value is taken out of the “pre-money valuation,” meaning you’ve got lower than expected. At this point you’re diluted 12.5% and so is everyone else.

Here’s how the math works.

The dilution at series A is 20% and the ESOP is 10%. To calculate the pre-money valuation, divide ESOP by minus 1 of series a dilution i.e. 10%/(1-20%).

The ownership at this point is:

- You own 70.9% (81% X 87.5%, which is 1 minus the 12.5%)

- The staff own 7.9%

- The seed investors own 8.8%

Once the investment closes, everyone apart from the capital investment company is diluted at 20%. That means:

- You own 56.7% (70.9% X 80%, which is 1 minus 20%)

- The staff own 6.3%

- The seed investors own 7%

- The capital investment company owns 20%

Keep in mind, there is a post-raise ESOP of 10%, meaning everything still adds up to 100%.

Series B

Wow! You now find an investor willing to put in 25% and needs you to top up the ESOP pool to keep it at 10%.

Here, you’ll dilute everyone by 25%, meaning;

- You own 41%

- Your staff own 4.6%

- The seed investors own 5.1%

- The capital investment company (the series A investors) owns 14.5%.

- The series B investors own 25%

- The ESOP is 10% of your startup

ESOP Pools

The end goal is to have 10% post-investment. So let’s dilute the 10% investment keeping in mind that there is ESOP left.

- Divide the 10% ESOP by minus 1 of the 25% investor stake

- Subtract the 10% ESOP

- Since the ESOP top-up will dilute you before the investment, gross up the top-up amount by 10%. As a result, the dilution is 3.67% and not 3.33%.

Easily Track Cap Tables with Professional Management Software

This brief breakdown is a great guide to understanding the cap table dilution calculation process in your company. However, with more and more investors coming in, it can get difficult to keep up. That’s why Astrella has designed professional cap table management software for companies like yours. Request the demo today and take control of your equity ownership.

Tom Kirby

Tom Kirby serves as the Head of Global Sales at Astrella. With more than 20 years of experience in sales and business development, he is dedicated to fostering strong client relationships and assisting both private and public companies in understanding and effectively communicating their value.

- Tom Kirby#molongui-disabled-link

- Tom Kirby#molongui-disabled-link

- Tom Kirby#molongui-disabled-link

- Tom Kirby#molongui-disabled-link