Startups thrive on innovative ideas, hard work, and overcoming various challenges. A critical aspect of a company's growth is developing and managing its equity through a pro forma cap table. For newcomers in the business world, creating a cap table can be daunting without the proper knowledge.

What is a Cap Table?

A cap table, or capitalization table, is a document that outlines the ownership structure of a company, detailing who owns how much of the business. It includes information on equity ownership, the value of equity, and equity dilution. Cap tables are crucial for making significant business decisions and play a vital role in the valuation of the company during fundraising rounds.

Understanding Pro Forma Cap Table

A pro forma cap table is a spreadsheet that projects a company’s capital structure after a future event, such as a funding round. It combines current data with assumptions about future events to show the percentage ownership, value of holdings, and potential dilution for each investor.

Key Users of Pro Forma Cap Tables

The main users of pro forma cap tables include:

- Founders

- Investors

- Venture capital firms

- Key employees with equity stakes

- Angel investors

- Executives

Benefits of a Pro Forma Cap Table

- Future Planning: Helps foresee potential changes in ownership stakes.

- Negotiation Tool: Assists in negotiating better terms with investors by providing visibility into post-financing dilution.

- Equity Compensation: Helps devise equity compensation strategies by projecting the impact of new option pools.

Contents of a Pro Forma Cap Table

- Equity Securities: Lists all types of equity securities, including shares, options, warrants, and convertible instruments.

- Ownership Percentages: Shows current and projected ownership percentages for each stakeholder category.

- Valuation: Displays the value of each stakeholder's holdings based on the projected post-event valuation.

Differences from Standard Cap Table

Differences between a standard cap table and a pro forma cap table are significant. A standard cap table reflects the current ownership structure of a company, providing a snapshot of who owns what at the present moment. In contrast, a pro forma cap table models the capital structure after a specific future event or scenario. This type of cap table allows for the input of various assumptions, such as the financing amount, share price, and issuance of new securities, to project potential changes in ownership and value.

Why Use a Pro Forma Cap Table?

A pro forma cap table is used for:

- Selling the Firm: Distributing proceeds after debt amongst shareholders.

- Future Planning: Showing key dates for converting warrants, options, and bonds to shares.

- Financing: Understanding ownership structure and its changes after financing rounds.

- Legal Documentation: Keeping records of shares and supporting legal documents.

- Ownership Data: Tracking shareholder information and vesting schedules.

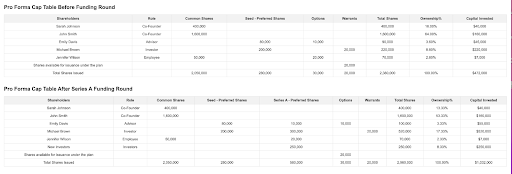

Example of a Pro Forma Cap Table

Tech Pro Inc. is a software company with the following ownership structure before and after a Series A funding round:

How to Create a Pro Forma Cap Table

Use Professional Help

Pro forma cap tables are essential for startups, but creating them manually can be time-consuming and prone to errors. Using cap table management platforms simplifies this process by automating key calculations, providing accurate insights, and modeling scenarios with ease. These platforms enable founders to make informed decisions and maintain transparency with stakeholders.

Creating a pro forma cap table requires precise knowledge and skills. Professionals like accountants and lawyers can help spot inaccuracies and ensure legal distinctions are maintained.

Evaluate the Company Correctly

Proper valuation is crucial. It should not be based on mental estimates but on a detailed analysis of factors such as location, industry, management team, and growth potential.

Ensure Correct Numbers

All figures on the cap table must be accurate, as they represent potential follow-up investments. Incorrect numbers can lead to financial losses for investors.

Avoid Ownership-Based Valuation

Valuation should not be based on maintaining existing shareholders' ownership percentages. It should reflect the actual financial needs and potential of the company.

Consider Convertible Securities

Convertible notes can affect the price per share and should be accurately reflected in the cap table to ensure fair investor exits.

Reconcile Amounts

Understand and reconcile any differences between wired amounts and investment figures to ensure accurate calculations.

Round Shares Appropriately

Decide whether to round up or down the number of shares based on transactional documents and investor preferences.

Key Components of a Pro Forma Cap Table

- Existing Securities: Lists all current equity securities.

- Assumptions for Future Events: Inputs for anticipated events.

- Projected Ownership: Shows updated ownership percentages post-event.

- Dilution Impact: Illustrates ownership stake dilution.

- Employee Stock Options: Models the impact of new option pools.

Pro Forma Cap Table FAQs

How Often Should a Pro Forma Cap Table Be Updated?

Update frequently, especially when significant changes occur to the capital structure or ownership.

Can a Pro Forma Cap Table Be Used for Tax Planning Purposes?

No, it is not suitable for tax planning purposes.

What Tools Can Help Automate the Creation of a Pro Forma Cap Table?

Tools like Astrella by EQ provide online templates that calculate share distributions, valuations, and investor equity based on user inputs.

What Role Does a Pro Forma Cap Table Play in Fundraising Rounds?

It provides transparency, aids in decision-making, and helps align expectations between companies and investors.

How to Create a Pro Forma Cap Table using Astrella by EQ

The first step is to log in or create an account on the Astrella website to start the process.

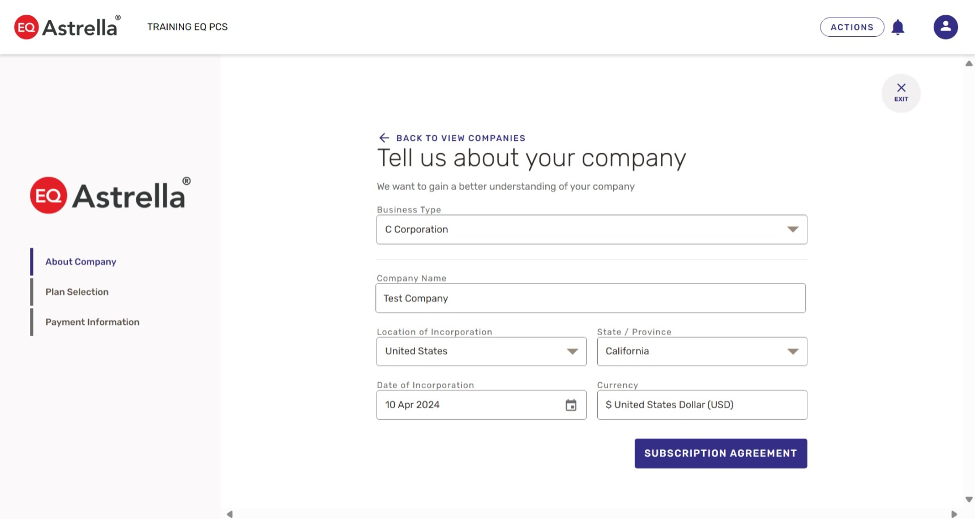

Once you have either logged in or created a new account you will be required to enter your company information.

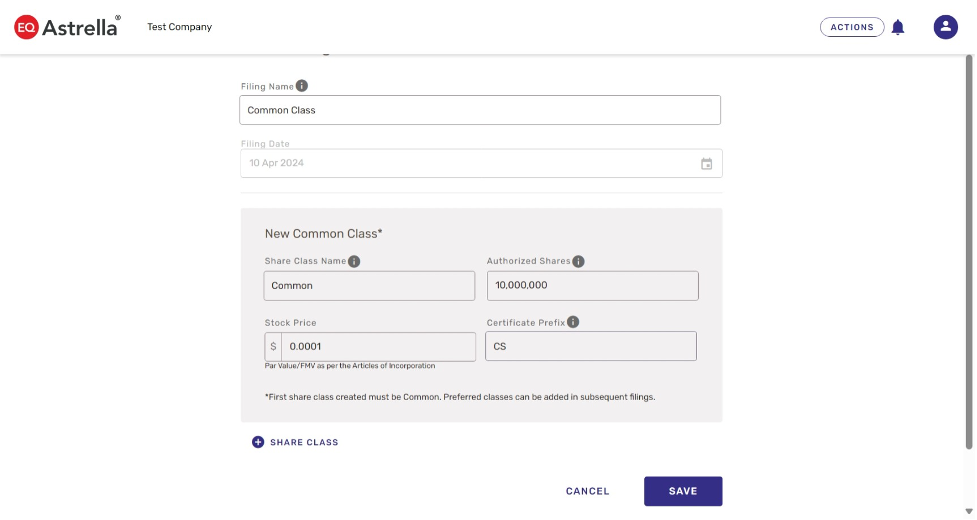

After entering your company information, you will want to create your common and preferred stocks classes by entering the total amount of shares in each class.

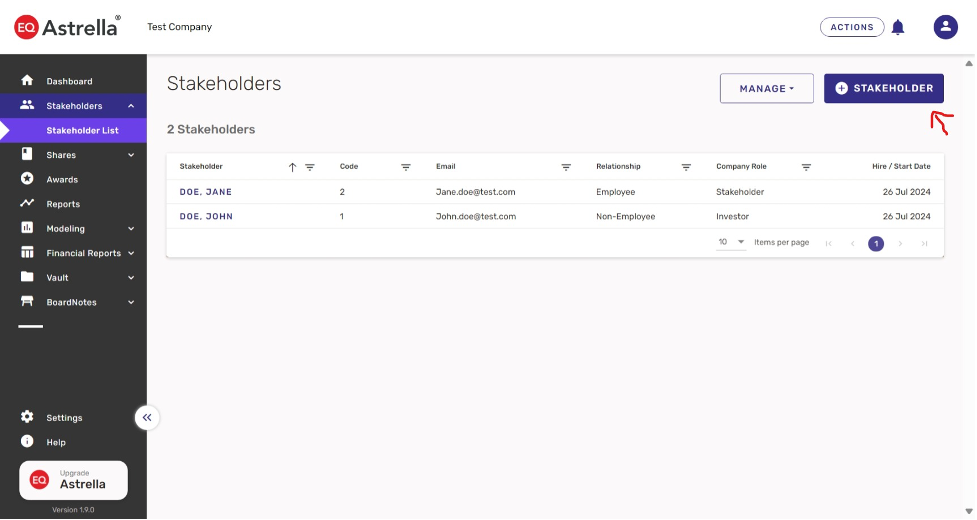

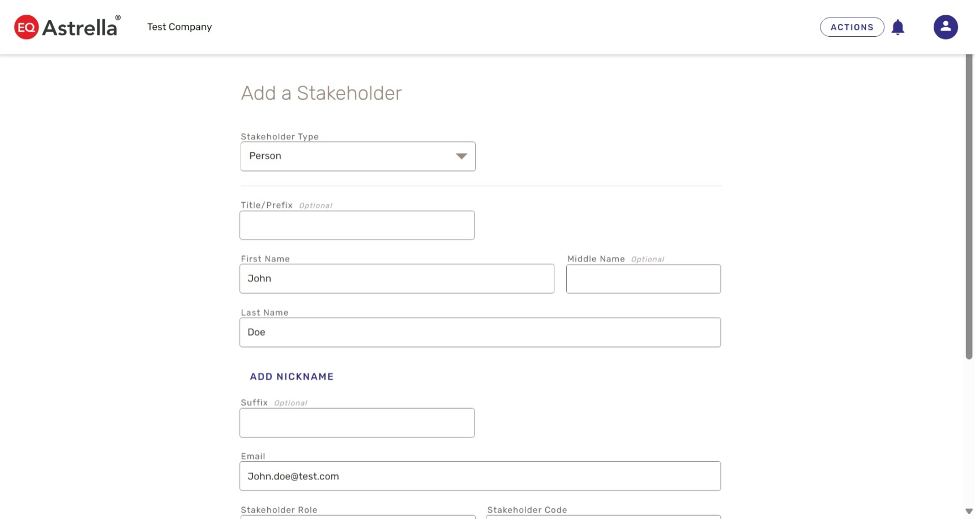

Now that you have created the share classes, the next step is to navigate to the “Stakeholders” tab on the left vertical menu navigation. Click on the add Stakeholder button on the top right. The required fields are First name, Last name & Email.

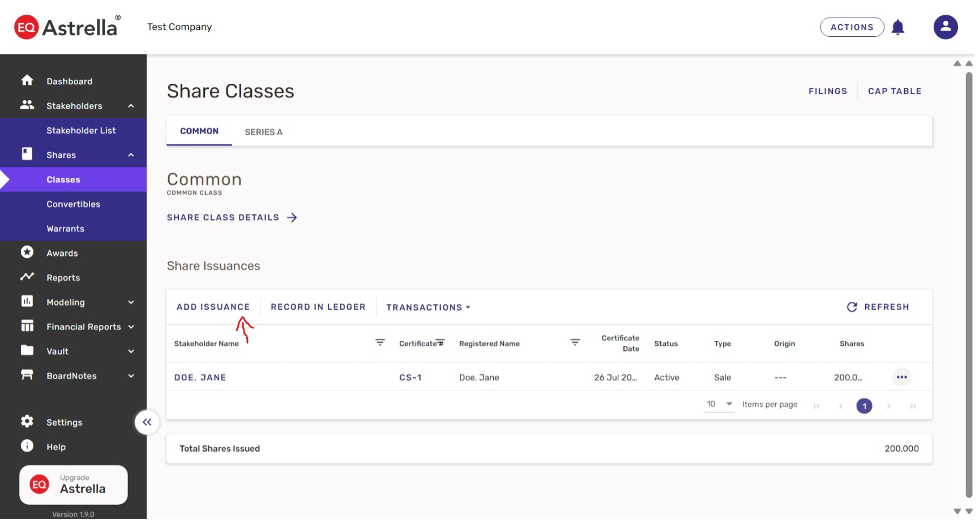

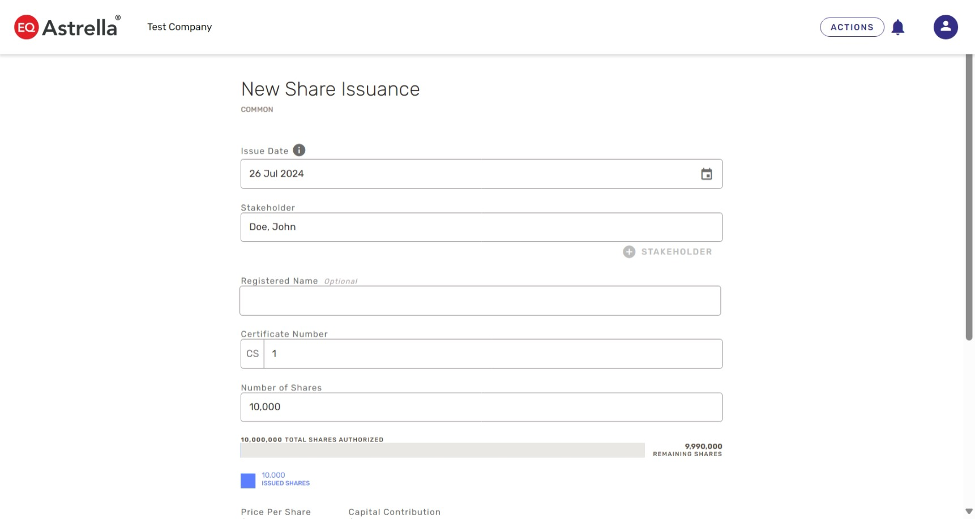

Now that all the Stakeholders are in the platform you will now distribute the stock owned by each stakeholder. To issue the stock navigate to the “Shares” tab on the left vertical menu and click on the drop-down arrow. Then select “Classes”. Now click on the “Add Issuance” button to issue the stock to the correct Stakeholder.

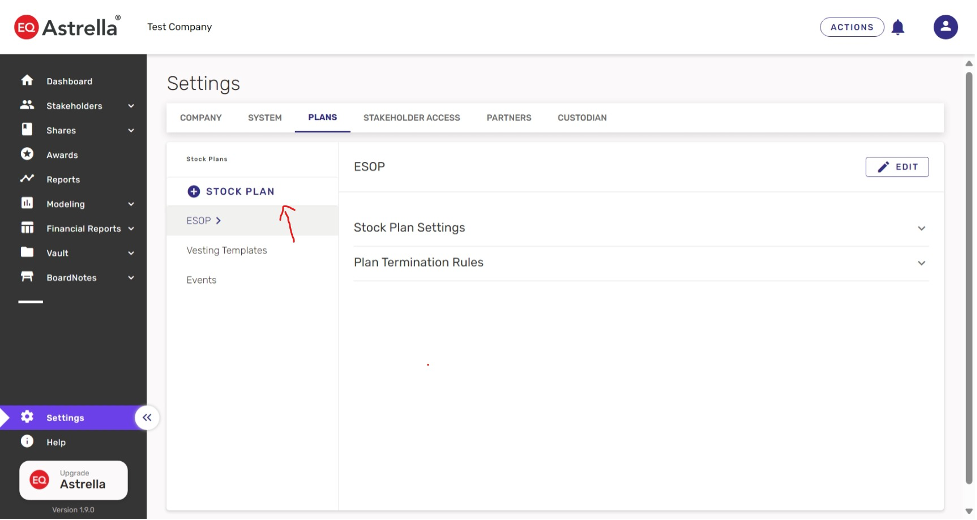

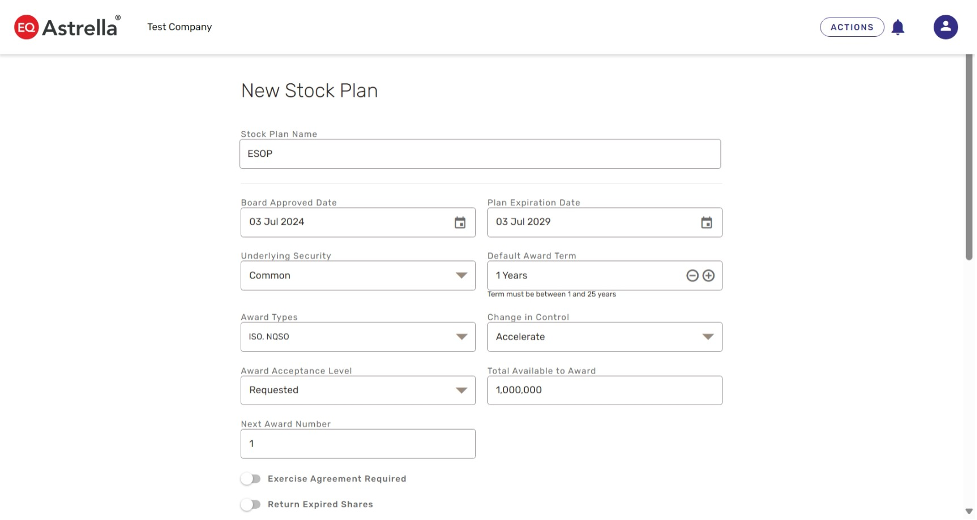

The next step is to create your Stock Plan by navigating to the “Settings” tab on the bottom left and selecting “Plans”. Then you can click the add Stock Plan button and enter the details around your plan.

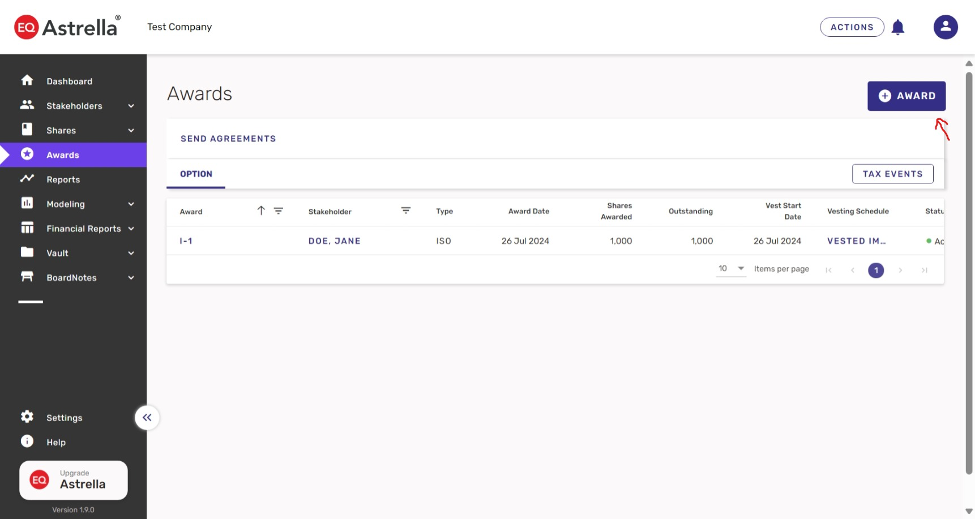

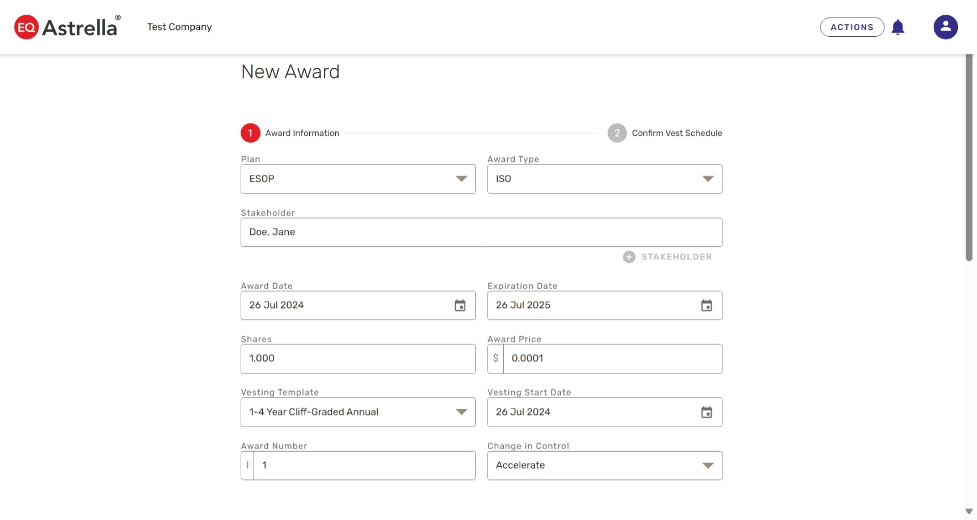

If you have option holders the next step is to issue the Options to the Stakeholders. Do this by selecting the “Awards” tab on the left vertical menu and clicking on the add award button in the top right. From there you can enter the option details.

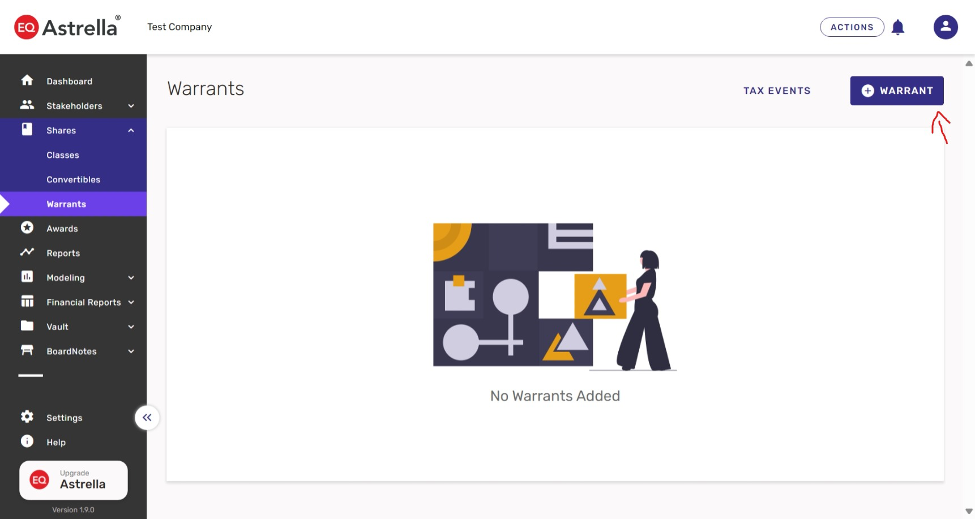

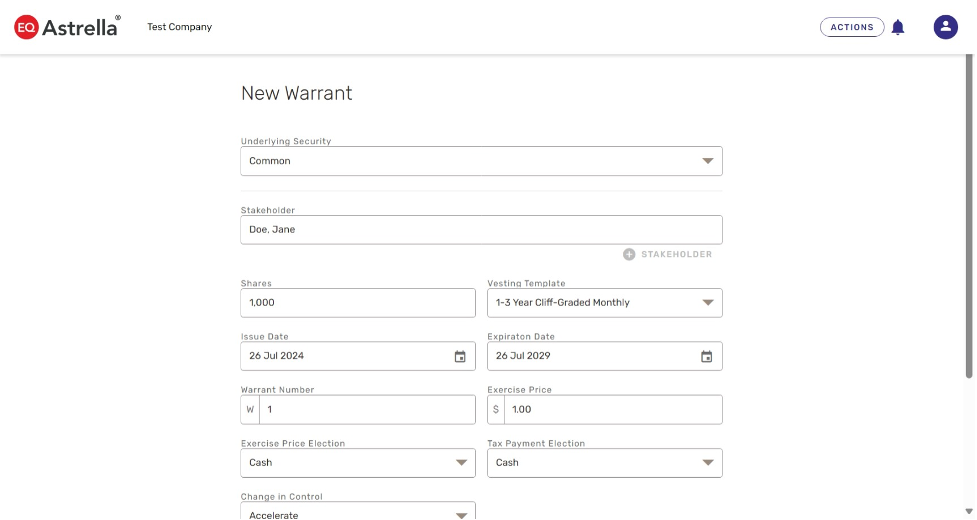

If Warrants are applicable, navigate to left vertical menu, select the Shares button and click the drop-down menu. Then click on “Warrants”. From there you can click on the add Warrant button in the top right corner and enter in the details of the Warrant.

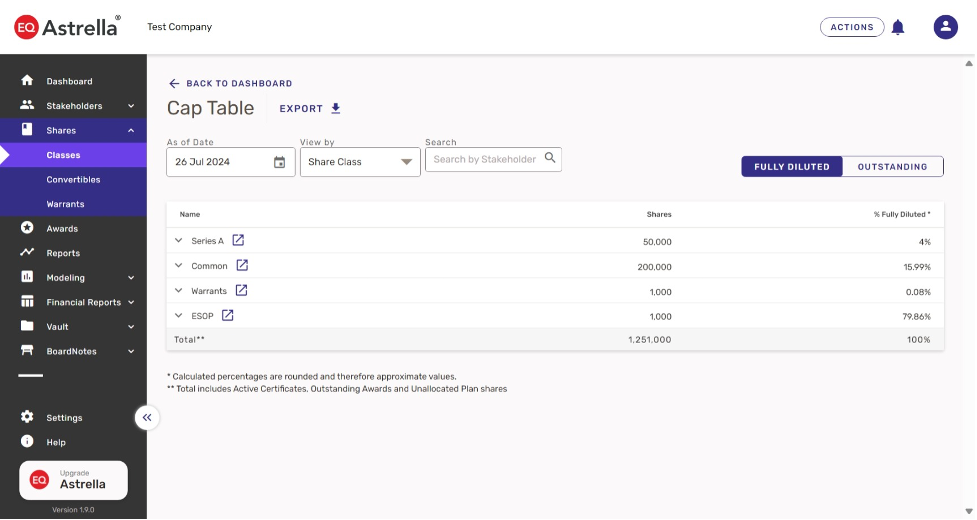

Now your cap table is ready to share with investors or model out your next round/exit!

Final Thoughts

A pro forma cap table is essential for startups to visualize their capital structure post-financing events. It helps negotiate fair terms, set accurate expectations, and make informed decisions. Using a Cap Table management platform like Astrella by EQ simplifies the process and ensures accurate and up-to-date cap tables.

Create your pro forma cap table with Astrella by EQ today and take control of your company’s financial future.

Tom Kirby

Tom Kirby serves as the Head of Global Sales at Astrella. With more than 20 years of experience in sales and business development, he is dedicated to fostering strong client relationships and assisting both private and public companies in understanding and effectively communicating their value.