In the competitive world of startups, securing funding is crucial for growth and success. Beyond traditional funding methods, startups can explore advanced strategies to attract investors and secure the capital they need. This blog post delves into various advanced fundraising strategies, including building a compelling pitch deck, leveraging crowdfunding platforms, networking with angel investors, securing government grants, and exploring venture debt financing. By understanding and implementing these strategies, startups can effectively tailor their fundraising approach to their unique needs and circumstances, increasing their chances of success in the competitive startup landscape.

Build a Compelling Pitch Deck

A well-crafted pitch deck is the cornerstone of a successful startup fundraising effort. It serves as a concise and compelling introduction to your startup, capturing the attention of potential investors and effectively communicating your business vision. To create a pitch deck that stands out, consider the following key elements:

1. Clearly articulate the problem your startup solves and its unique value proposition.

Begin your pitch deck by succinctly explaining the problem your startup addresses and why it matters. Highlight the pain points of your target audience and demonstrate how your product or service offers a unique and innovative solution. Your value proposition should be clear, concise, and differentiate your startup from competitors.

2. Provide a concise overview of the target market, size, and growth potential.

Identify your target market and provide insights into its size, growth potential, and key characteristics. Demonstrate a deep understanding of your customer base and their needs. Quantify the market opportunity by presenting relevant statistics, industry reports, or market research findings. Show that there is a substantial and growing demand for your product or service.

3. Highlight key milestones achieved and traction gained.

Showcase your startup’s progress and achievements to date. Highlight key milestones reached, such as product launches, user acquisition, revenue generation, or partnerships secured. Provide evidence of traction gained, such as user growth, positive customer feedback, or industry recognition. These accomplishments demonstrate the viability and potential of your startup.

4. Present a well-defined business model and revenue streams.

Clearly outline your startup’s business model and how it generates revenue. Explain the sources of revenue, pricing strategy, and projected financial performance. Demonstrate a clear path to profitability and sustainability. Investors want to see a well-thought-out plan for how your startup will generate revenue and achieve financial success.

5. Include a strong and experienced management team.

Introduce your management team and highlight their relevant industry expertise, accomplishments, and track records. Emphasize the strength and diversity of your team, showcasing the skills and experience necessary to execute your business plan effectively. Investors place a high value on the quality of the team behind the startup.

Leverage Crowdfunding Platforms

Leveraging crowdfunding platforms has emerged as a viable alternative for startups seeking to raise capital. These platforms enable entrepreneurs to bypass traditional funding routes and directly connect with a large pool of potential investors, often referred to as “backers.” The success of crowdfunding campaigns hinges on several crucial factors.

- Selecting the right platform is paramount. Various platforms cater to different types of startups and offer unique features. Thorough research is essential to identify a platform that aligns with your startup’s industry, target audience, and funding goals.

- Creating a compelling campaign page is the key to attracting backers. This involves crafting a concise and engaging pitch that effectively communicates your startup’s mission, market opportunity, and value proposition. High-quality visuals, such as videos and images, can significantly enhance the appeal of your campaign.

- Promoting your campaign is crucial to reaching a wider audience and increasing your chances of success. Utilize social media, email marketing, and other digital channels to spread the word about your campaign. Engaging with potential backers through regular updates, responding to questions, and offering incentives can help build momentum and attract more support.

- Crowdfunding platforms offer a unique opportunity for startups to raise capital and build a community of supporters. By carefully selecting the right platform, creating a compelling campaign page, and actively promoting your campaign, you can increase your chances of a successful crowdfunding campaign.

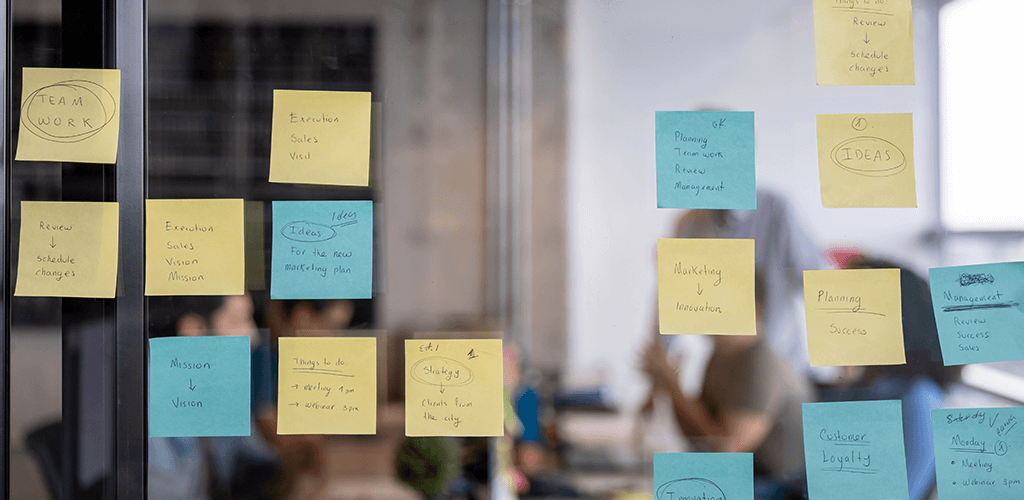

Network with Angel Investors

Networking with angel investors is an essential aspect of startup fundraising. Angel investors are affluent individuals who invest in early-stage startups, providing critical funding and mentorship. To successfully network with angel investors, consider the following strategies:

- Attend industry events. Industry events, such as conferences, trade shows, and meetups, provide opportunities to connect with angel investors who share your interests. Participate in panel discussions, networking sessions, and one-on-one meetings to showcase your startup and build relationships with potential investors.

- Join angel investor networks. Angel investor networks are organizations that connect startups with angel investors. These networks often provide access to exclusive events, mentorship programs, and pitch competitions. Joining an angel investor network can significantly expand your network and increase your chances of securing funding.

- Pitch your startup at investor forums. Investor forums are events where startups pitch their businesses to a panel of angel investors. These forums provide a platform to present your startup, receive feedback, and attract potential investors. To make the most of investor forums, prepare a compelling pitch, practice your delivery, and be ready to answer questions from investors.

- Use online platforms to connect with angel investors. Several online platforms connect startups with angel investors. These platforms provide a convenient way to showcase your startup, share your business plan, and attract potential investors. When using online platforms, create a compelling profile, highlight your key achievements, and actively engage with angel investors.

- Leverage your personal network. Your personal network can be a valuable resource for connecting with angel investors. Reach out to friends, family, colleagues, and acquaintances who may have connections to angel investors or be interested in investing in startups. Attend social events, industry gatherings, and community meetings to expand your network and identify potential investors.

Remember, building relationships with angel investors takes time and effort. Be persistent, professional, and authentic in your interactions. Tailor your approach to each investor, highlighting how your startup aligns with their investment interests and values. By effectively networking with angel investors, you can increase your chances of securing funding and gaining valuable support for your startup’s growth.

Secure Government Grants

Government grants offer a valuable source of non-repayable funding for startups. To secure government grants, it is crucial to conduct thorough research to identify relevant grants that align with your startup’s goals and industry. Each grant typically has specific eligibility criteria and application requirements, so carefully review and ensure that your startup meets all the necessary conditions. Preparing a strong application is essential, clearly demonstrating the potential impact of your startup, its scalability, and the ability to deliver on your proposed objectives. Networking with government officials and grant administrators can provide valuable insights into the grant process and enhance your chances of success. Be prepared to provide additional information or pitch your startup during the grant review process, effectively communicating your vision and the potential benefits of supporting your project.

Explore Venture Debt Financing

Venture debt financing provides startups with an alternative source of capital in the form of loans, rather than equity dilution. This option is particularly suitable for startups with a proven business model and revenue generation, seeking additional funding to scale their operations. While venture debt typically carries higher interest rates compared to traditional bank loans, it offers a more favorable option compared to the equity dilution associated with venture capital financing.

Venture debt providers often require startups to provide personal guarantees or collateral to secure the loan, ensuring a level of risk mitigation for the lender. The repayment terms for venture debt are typically structured, with fixed interest rates and a predetermined repayment schedule. This predictability in repayment can be advantageous for startups in managing their cash flow and financial planning.

Startups considering venture debt financing should carefully evaluate their financial situation and growth trajectory to determine if this option aligns with their strategic goals. It is advisable to consult with financial advisors or experts in startup funding to gain a comprehensive understanding of the terms, risks, and benefits associated with venture debt financing before making a decision.

Conclusion

In conclusion, to ensure successful startup fundraising, it is crucial to adopt a comprehensive strategy that aligns with your specific business goals and circumstances. Building a compelling pitch deck, networking with angel investors, exploring crowdfunding platforms, securing government grants, and considering venture debt financing are all viable options to explore. However, it is essential to thoroughly research each funding source, understand its terms and requirements, and tailor your approach accordingly. Seeking professional advice from financial experts or experienced entrepreneurs can provide valuable guidance throughout the fundraising process. Remember, success in fundraising requires dedication, persistence, and a willingness to adapt your strategy as needed. Embrace the challenges and opportunities that come with startup fundraising, and take the necessary steps to secure the funding your business needs to thrive and achieve its full potential.

Cap table management software for startups can revolutionize the way companies track and manage their ownership structure. By digitizing the process of maintaining a cap table, startups can streamline equity management, ensure accuracy in ownership records, and facilitate transparency with investors. This software automates calculations for equity distribution, making it easier to issue stock options, track convertible securities, and manage equity dilution. Additionally, it provides real-time insights into the ownership landscape, empowering startups to make informed decisions about fundraising, equity allocation, and corporate governance. Overall, cap table management software offers startups a scalable solution to navigate the complexities of equity management and drive their growth journey with confidence.

Tom Kirby

Tom Kirby serves as the Head of Global Sales at Astrella. With more than 20 years of experience in sales and business development, he is dedicated to fostering strong client relationships and assisting both private and public companies in understanding and effectively communicating their value.